Tax Evasion: Meaning, Definition, and Penalties

Por um escritor misterioso

Last updated 20 setembro 2024

:max_bytes(150000):strip_icc()/taxevasion.asp_final-8be1e7bf4edc49d3add2ba8af2a2d521.png)

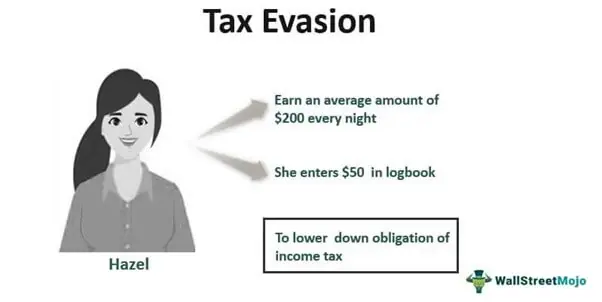

Tax evasion is an illegal practice where a person or entity intentionally does not pay due taxes.

Tax Dictionary - Tax Evasion

Taxation in the United States - Wikipedia

What is an IRS Accuracy Related Penalty?

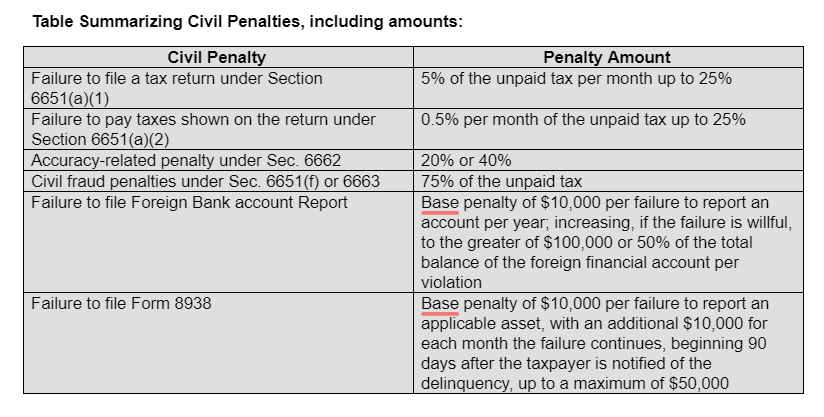

What is the Difference Between Criminal Tax Penalties and Civil Tax Penalties?

Tax evasion - Wikipedia

Tax evasion: The Dangers of Tax Evasion on Your Effective Tax Rate - FasterCapital

Understanding the IRS and Cryptocurrency: Penalties, Tax Evasion, and Compliance

Blowing the Whistle on Tax Evasion to the IRS · KKC LLP

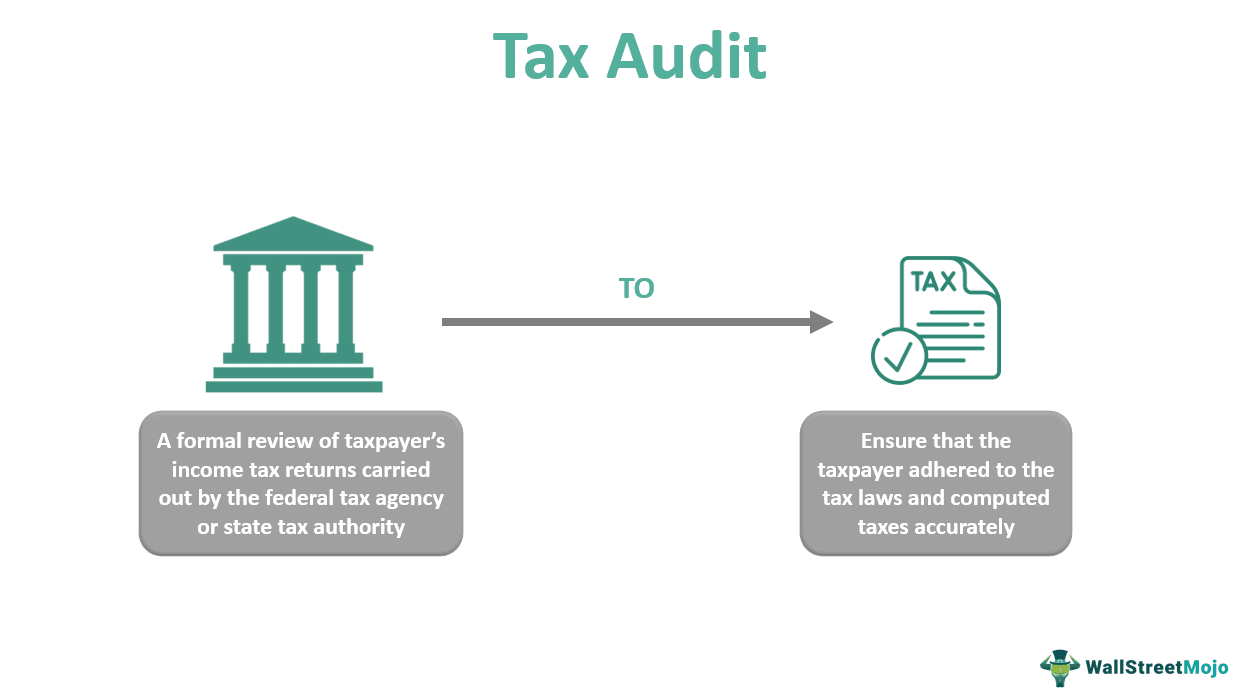

Tax Audit - What Is It, Types, Reasons, Example, Vs Statutory Audit

Tax Evasion - Meaning, Types, Examples, Penalties

Difference Between Tax Planning

Concept of Tax Evasion & Tax Avoidance: Definition and Differences

Recomendado para você

-

What is 'Press F To Pay Respects' (The Origin?) - NeoGamr20 setembro 2024

What is 'Press F To Pay Respects' (The Origin?) - NeoGamr20 setembro 2024 -

Pay Re$pect Clothing Brand20 setembro 2024

Pay Re$pect Clothing Brand20 setembro 2024 -

What does FRR mean in slang? - Quora20 setembro 2024

-

Online Terms, Slang and Acronyms you need to know // SMPerth20 setembro 2024

Online Terms, Slang and Acronyms you need to know // SMPerth20 setembro 2024 -

Press F to Pay Respects (Western Civilisation)20 setembro 2024

Press F to Pay Respects (Western Civilisation)20 setembro 2024 -

What Are Computer Information Systems? Definition, Degree, and20 setembro 2024

What Are Computer Information Systems? Definition, Degree, and20 setembro 2024 -

:max_bytes(150000):strip_icc()/socialnetworking-13cadb0b8b5941ab999a13c06e468821.jpg) What Is Social Networking?20 setembro 2024

What Is Social Networking?20 setembro 2024 -

The Doughnut Economics: definition and critical analysis20 setembro 2024

The Doughnut Economics: definition and critical analysis20 setembro 2024 -

What Is a Database? (Definition, Types, Components)20 setembro 2024

What Is a Database? (Definition, Types, Components)20 setembro 2024 -

Urban sprawl Definition, Examples, Problems, Causes20 setembro 2024

Urban sprawl Definition, Examples, Problems, Causes20 setembro 2024

você pode gostar

-

Uma opção para revolucionar o desenvolvimento de videogames para20 setembro 2024

Uma opção para revolucionar o desenvolvimento de videogames para20 setembro 2024 -

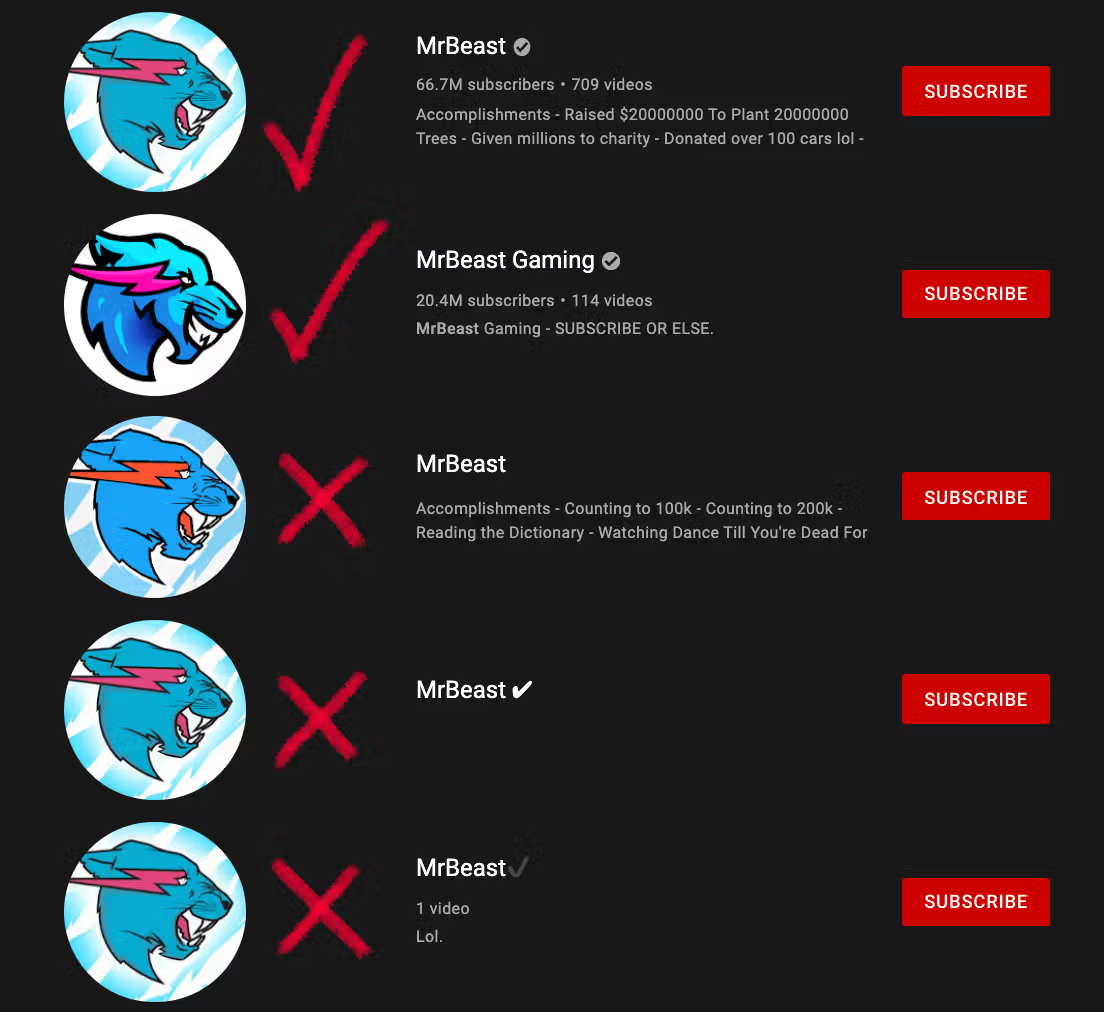

How to Pick a Good Channel Name20 setembro 2024

How to Pick a Good Channel Name20 setembro 2024 -

Super Mario Wonder is Wonderful20 setembro 2024

Super Mario Wonder is Wonderful20 setembro 2024 -

X 上的 ZeddsArt:「MY BOY MATT!! :D T-pose on all em #eddsworldfanart #eddsworld / X20 setembro 2024

-

Moto X3M Bike Race Game – Apps on Google Play20 setembro 2024

-

Daily The Latest Top Crypto Game, Best NFT Gaming, Web3 Games News20 setembro 2024

Daily The Latest Top Crypto Game, Best NFT Gaming, Web3 Games News20 setembro 2024 -

SP4/27/30 – Valentina Hair20 setembro 2024

SP4/27/30 – Valentina Hair20 setembro 2024 -

Emotion Letter B Alphabet Lore, Angry Latter Alphabet Lore Poster20 setembro 2024

Emotion Letter B Alphabet Lore, Angry Latter Alphabet Lore Poster20 setembro 2024 -

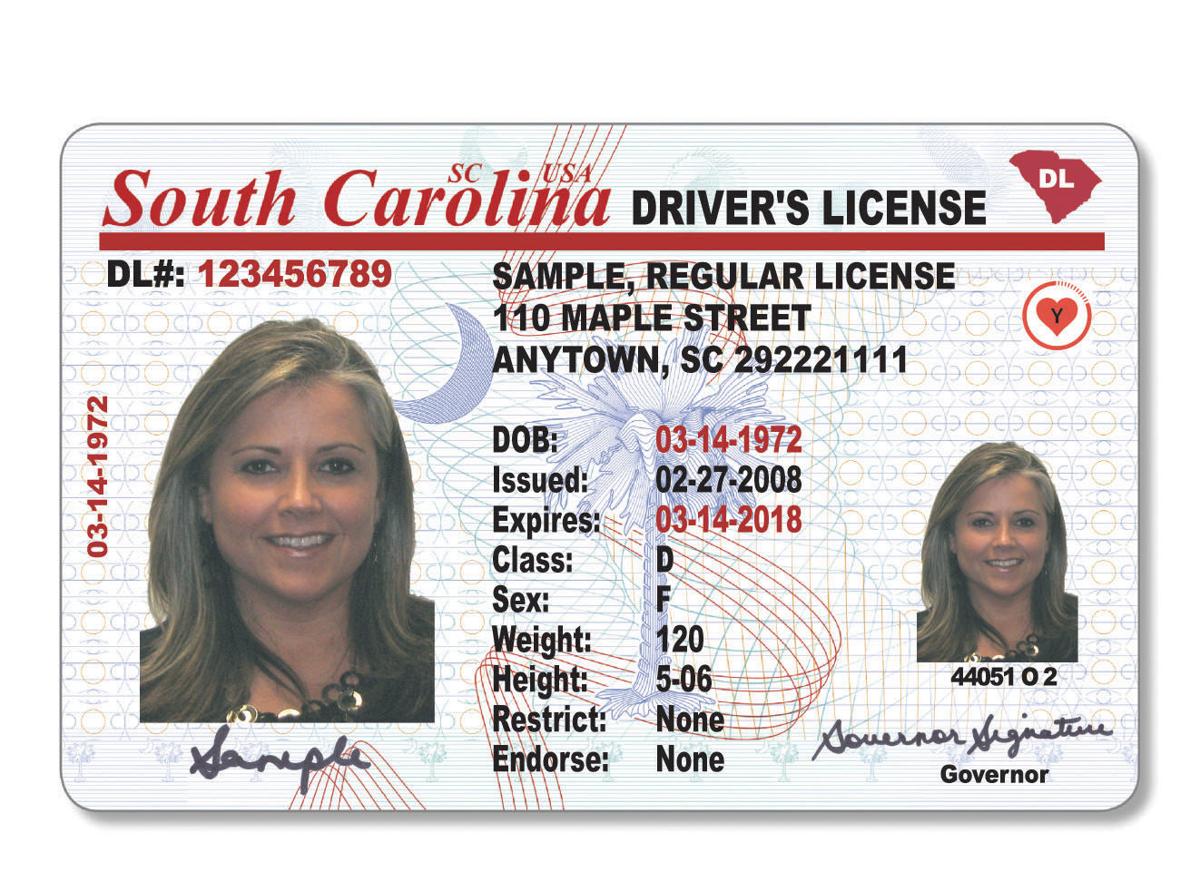

South Carolina rolling out new driver's licenses to meet government's REAL ID rules, News20 setembro 2024

South Carolina rolling out new driver's licenses to meet government's REAL ID rules, News20 setembro 2024 -

Download do APK de Quiz Matemática para Android20 setembro 2024

Download do APK de Quiz Matemática para Android20 setembro 2024